Overview

The following project presents a high-performance arbitrage bot designed for decentralized exchanges on the Algorand blockchain. The bot leverages atomic transactions and custom smart contracts to enable automated trading with precision and security. It features built-in profit verification and risk management mechanisms to ensure reliable and efficient execution of arbitrage strategies.

🌐 Explore the project on allo.info

Proof of ownership

This transaction proves my ownership of this address. Please refer to the "note" field for verification.

What is AMM (Automated Market Makers) and how they work

Credit: WhiteboardCrypto

Automated Market Makers (AMMs) are the backbone of decentralized exchanges (DEXs), representing a paradigm shift from traditional order book systems to a more automated and decentralized approach. Here's how they work:

Core Concepts

-

Liquidity Pools

- Instead of matching buyers with sellers, AMMs use liquidity pools

- These pools contain pairs of tokens (e.g., ALGO/USDC)

- Liquidity providers (LPs) deposit both tokens in a specific ratio

-

The Constant Product Formula

- AMMs typically use the formula: x * y = k

- Where x and y are the quantities of two tokens

- k must remain constant after trades

- This creates an automatic pricing mechanism

How Trading Works

-

Price Determination

- Prices are determined by the ratio of tokens in the pool

- When users trade, they alter this ratio

- Larger trades cause more significant price impact

-

Slippage

- Slippage occurs when a trade executes at a less favorable price than expected due to changes in the market during transaction processing.

Example

Let's say we have a pool with:

- 100 ALGO

- 200 USDC

- k = 100 * 200 = 20,000

If someone wants to buy ALGO:

- The price will increase as ALGO is removed

- The pool must maintain k = 20,000

- This creates a natural price curve

Advantages

- Always available liquidity

- Permissionless trading

- Transparent pricing

- No need for order matching

Disadvantages

- Price slippage on large trades

- Impermanent loss for liquidity providers

- Less capital efficient than order books

Explaining MEV bots

MEV Bots and Their Impact on DeFi

Maximal Extractable Value, formerly Miner Extractable Value, defines a profit that could be extracted through reordering, insertion, or censoring any transaction in a block. An MEV bot refers to a set of automated programs designed to identify and capture this profit opportunity in DeFi.

Common Types of MEV Bots

-

Arbitrage Bots

- Monitor price differences across multiple DEXs

- Execute trades to profit from price discrepancies

- Help maintain price equilibrium across markets

- Generally considered beneficial for market efficiency

-

Front-Running Bots, also known as Sandwich Attacks

- Monitor pending transactions in the mempool.

- Place similar transactions with higher fees to execute first.

- Then execute a back-running transaction to profit from the resulting price impact.

Key Indicators for Arbitrage Bot Success

Positive Indicators

-

Blockchain Characteristics

- Fast block finality

- Low transaction fees

- High TPS (Transactions Per Second)

- Reliable node infrastructure

-

Market Metrics

- High TVL (Total Value Locked) across DEXs

- Active trading volume

- Multiple competing DEXs

- Significant price volatility

-

Token Ecosystem

- Large number of active trading pairs

- Tokens with high market caps

- Diverse token standards support

- Strong liquidity across pairs

Red Flags

-

Technical Limitations

- High node hardware requirements

- Network congestion

- Unreliable RPC endpoints

- High latency

-

Market Concerns

- Low trading volume

- Small TVL in DEXs

- Limited number of DEXs

- Thin liquidity

Algorand Advantages

- Minimal hardware requirements

- 3 second finality

- Low transaction fees

- Atomic transactions support

- Growing DeFi ecosystem

Implementation and Technical Flow

Mempool Monitoring and Opportunity Detection

The bot continuously monitors the Algorand mempool for DEX-related transactions. It analyzes price differences between DEX pairs (like Tinyman and Humble DeFi) looking for these types of opportunities:

- Direct pair arbitrage (Token A/B on DEX1 vs DEX2)

- Triangular arbitrage (Token A → B → C → A)

- other opportunities...

Smart Execution Process

-

When an opportunity is detected, the bot:

- Calculates potential profit considering fees

- Estimates slippage impact

-

If profitable, constructs an atomic transaction group that:

- Executes swaps across DEXs

- Includes a verification smart contract

-

The smart contract:

- Verifies final output amount

- Automatically rejects if there is no profit, or there is a loss

- Ensures all transactions succeed or fail together (done by the atomic transaction)

Automated Reporting

A weekly cron job sends performance reports via email including:

- Total profit/loss

- Number of successful arbitrages

- Gas fees spent

- Failed transaction analysis

- Market opportunities overview

This automated system provides constant monitoring while ensuring risk-free execution through atomic transactions and smart contract verification, making it impossible to lose funds due to market movements during execution.

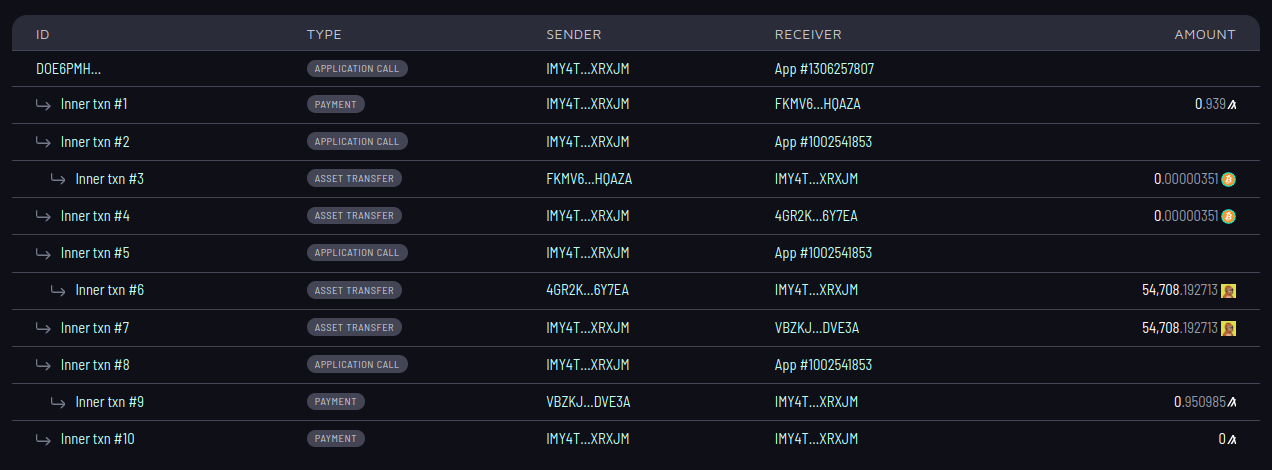

A Real Example

As you can see we started with 0.939 Algo and we swap them with 0.00000351 A-Token then we swap them again to 54,708.192713 B-Token, finally we swap the amount back to Algo at the end we got 0.950985 Algo which is greater than the amount that we started with, and this operation is happen frequently every day, at the moment of writing this blog the Bot perform more than 900_000 transaction.

Summary

Arbitrage bots serve as essential market balancers in DeFi, automatically equalizing prices across exchanges while distributing liquidity between pools.

Definitions

- TVL: Total Value Locked is a metric used to measure the total value of digital assets that are locked or staked in a particular decentralized finance (DeFi) platform or distributed application (DApp).

- Slippage: Slippage refers to the difference between the expected price of a trade and the price at which the trade is executed (Time).

- Price impact: Price impact refers to how an individual trade influences the market price of an asset in between that trade’s execution and completion (your individual trade).

- order book:

- Limit: You are the price maker (you have to wait until find some one who want to buy from you with that price).

- Market: You buy with the most optimized price on the market.

- AMM: Automated Market Maker is a type of decentralized exchange (DEX) protocol that relies on mathematical formulas to price assets and facilitate trading without the need for a traditional order book.

- Data Aggregators: Platforms or tools that collect, organize, and present data from multiple sources, often used in DeFi to provide users with comprehensive information about prices, liquidity, and other metrics across various platforms.

- Impermanent loss: A temporary loss of funds that occurs when providing liquidity to a liquidity pool, caused by the price divergence of the pooled assets compared to simply holding them.

- Atomic transaction: A transaction that is executed completely or not at all, ensuring that all operations within the transaction succeed or fail as a single unit, commonly used in blockchain to maintain consistency and prevent partial execution.

Resources

- DefiLlama: A platform that tracks and aggregates data on Total Value Locked (TVL) across various DeFi protocols and blockchains.

- Pact: A decentralized exchange (DEX) on the Algorand blockchain for swapping tokens.

- Tinyman: A decentralized trading protocol and automated market maker (AMM) on the Algorand blockchain.

- Folks Finance: A decentralized Dex platform built on Algorand.

- Humble: A decentralized exchange (DEX) and liquidity provider on the Algorand blockchain.

- Cometa: A yield farming and liquidity aggregation platform on Algorand.

- Algodex: A decentralized order book exchange for trading Algorand Standard Assets (ASAs).

- Ultrade: A decentralized trading platform offering advanced trading tools and features.

- Algofi: A DeFi platform on Algorand offering stablecoin services.